what is suta taxable wages

Some states require employees to cover a portion of the taxes so money may. In some cases however the employee may also have to.

The True Cost To Hire An Employee In Texas Infographic

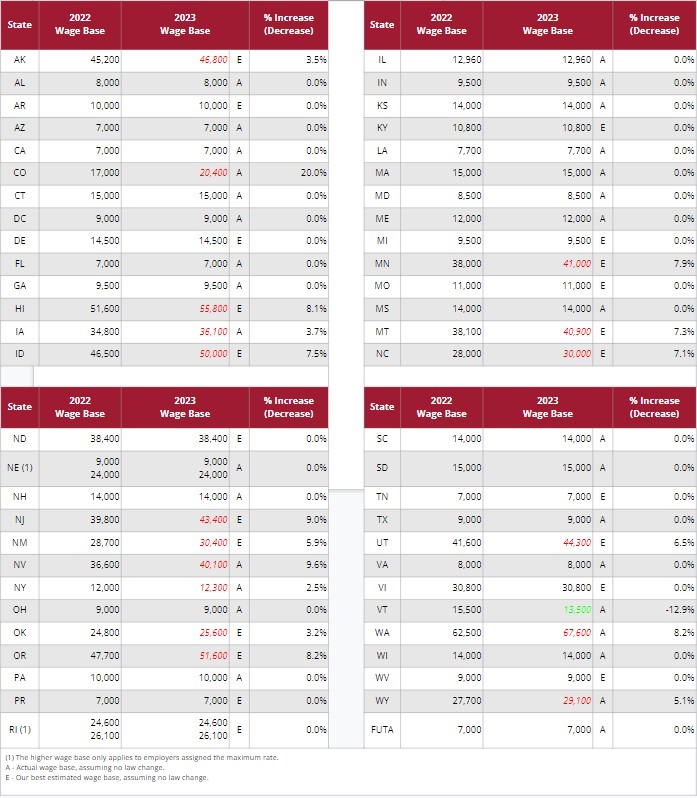

Additional Assessment for 2022 from 1400 to 000.

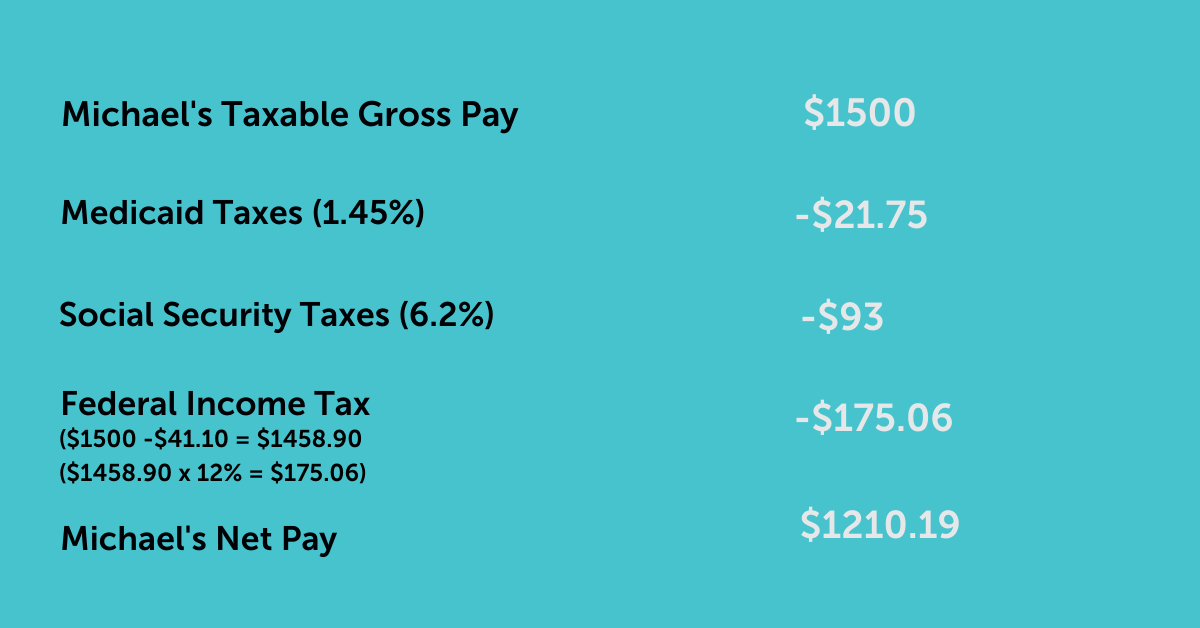

. Employees must pay 765 of their wages as FICA tax to fund Medicare 145 and Social Security 62. The amount of the tax is based on the employees wages and the states unemployment rate. Your state will assign you.

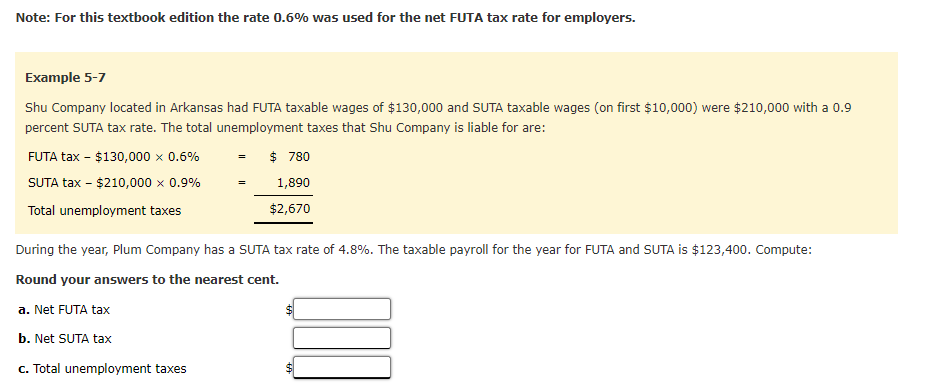

The worst positive-rate class was assigned a tax rate of 691 percent resulting in a tax of 32131 when multiplied by the 46500 wage base. FUTA is a tax that employers pay to the federal government. The Medicare percentage applies to all earned wages while the Social.

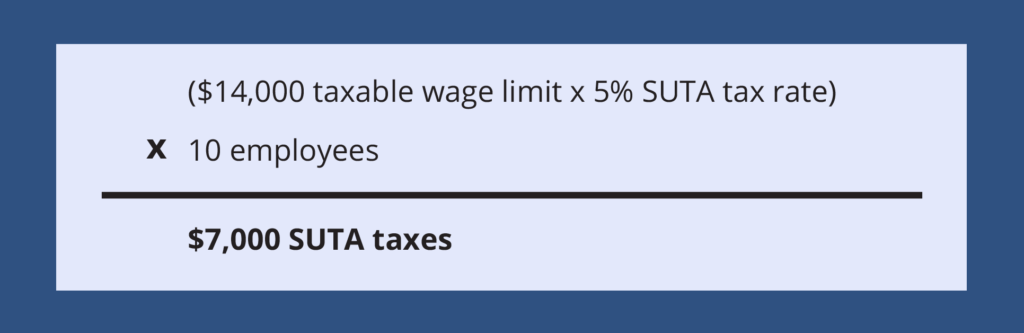

Current Tax Rate Filing Due Dates. The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. Most states send employers a new SUTA tax rate each year.

Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. Special Assessment Federal Loan Interest Assessment for. The SUTA tax rate and wage base vary by state.

General employers are liable if they have had a quarterly payroll of. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The new law reduces the.

The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on. The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars 10000 per employee per calendar. Taxable base tax rate.

Even though you only pay unemployment taxes on the taxable wage base you still must. The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. The best negative-rate class was assigned a rate.

Generally states have a range of unemployment tax rates for established employers. The Reemployment Tax is exclusive to Florida and the Florida Department of Revenue has administered the tax since 2000. The State Unemployment Tax Act SUTA tax is much more complex.

It serves the same purpose as the. Base Tax Rate for 2022 from 050 to 010. For state unemployment tax purposes only the first 9000 paid to an employee by an employer during a calendar year constitutes taxable wages An employer cannot count.

The tax applies only to. The states SUTA wage base is 7000 per. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages.

24 new employer rate Special payroll tax. Employees do not pay any FUTA tax or have anything subtracted from their paychecks. Wages do not include jury-duty pay death benefits or sick leave under a qualified plan.

State Unemployment Tax Act SUTA tax.

View All Hr Employment Solutions Blogs Workforce Wise Blog

Suta Vs Futa What You Need To Know

How To Pay State Unemployment Tax Suta Businessnewsdaily Com

State Unemployment Tax Act Suta Bamboohr

Exercise 11 5 Docx Exercise 11 5 Computing Suta Tax Lo 11 6 11 5 On April 30 2019 Chung Furniture Company Prepared Its State Unemployment Tax Course Hero

Gross Pay Vs Net Pay What S The Difference Aps Payroll

Unemployment Insurance Taxes Iowa Workforce Development

Fast Unemployment Cost Facts For Montana First Nonprofit Companies

What S The Cost Of Unemployment Insurance To The Employer

Solved Note For This Textbook Edition The Rate 0 6 Was Chegg Com

What Is Suta Understanding Unemployment Tax Basics

Solved The Employees Of Portonegra Company Earn Wages Of 15 600 For The Two Weeks Ending April 12

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

Suta Wages Taxes Microsoft Dynamics Gp Forum Community Forum